First-timer Families

Priority benefits

- 3 ballot chances islandwide when FT(PMC) applicants apply for BTO flats, 1 more than other first-timer applicants.

- Qualify for the Family and Parenthood Priority Scheme (FPPS), where up to 40% of BTO flats and 60% of flats sold at Sale of Balance Flats (SBF) exercises are set aside for eligible first-timer families.

- First priority for a 4-room or smaller BTO flat in Standard projects under FPPS.

Find out more about the FT(PMC) category here.

Grants

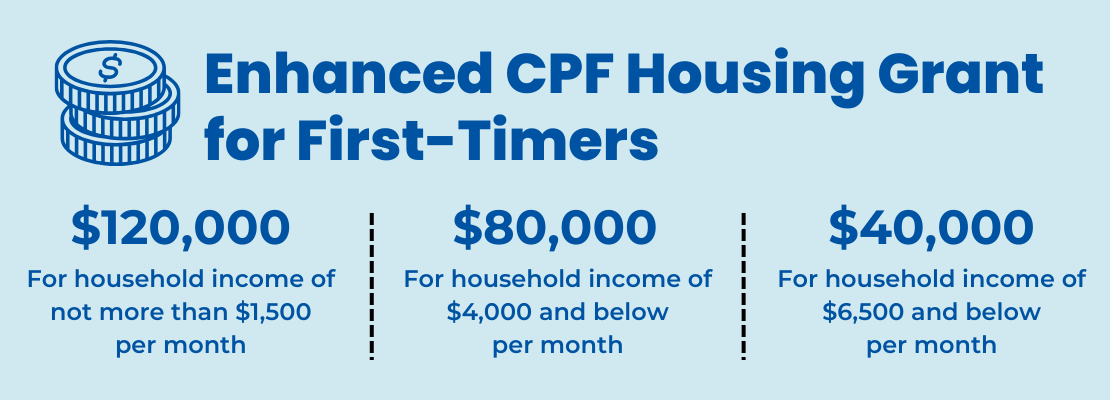

New flats sold by HDB are priced with significant market discounts. On top of this price discount, eligible first-timer families who buy a BTO flat can enjoy an Enhanced CPF Housing Grant (EHG) of up to $120,000.

Find out more about the Enhanced CPF Housing Grant here.

Those who prefer to move in quickly and/or have specific preferences on location may wish to buy a resale flat. First-timer families buying resale flats can enjoy up to $230,000 in housing grants.

Find out more about the various schemes and grants here.

Second-timer Families

Second-timer families are those who have previously owned a subsidised flat. Besides existing homeowners, there are also second-timer families who are currently living in a rental flat. These families may have previously owned a flat, but encountered difficulties such as the loss of a loved one or unemployment, sold their flat, and are now staying in public rental housing. As second-timers, they find it harder to afford another HDB flat because they no longer qualify for housing grants, which are mostly given to first-timers. Many aspire to own a home again, to give themselves and their children a better future.

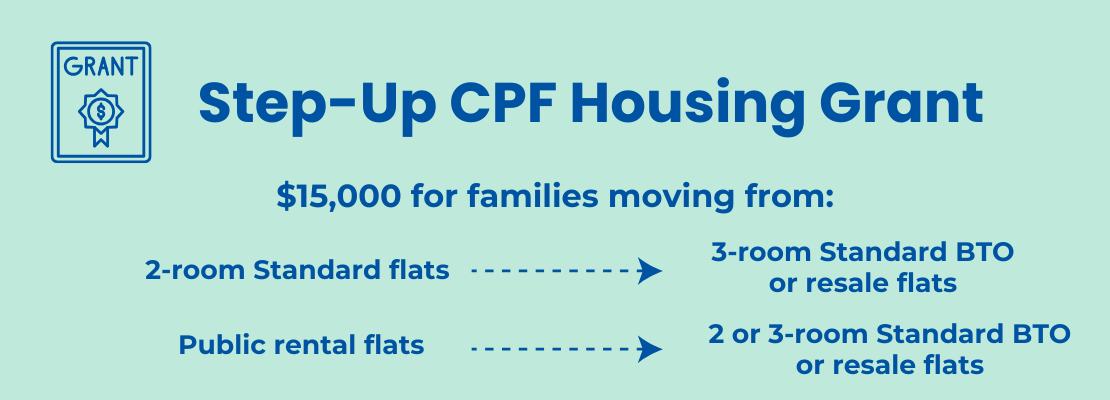

Step-Up CPF Housing Grant

Second-timer lower-income families may receive the Step-Up CPF Housing Grant of $15,000 to help with their new or resale flat purchase.

Find out more about the Step-Up CPF Housing Grant here.

Assistance Scheme for Second-Timers (Divorced/Widowed Parents) (ASSIST)

Some families may need help accessing a flat more quickly, following major life changes such as divorce or demise of family member. Under ASSIST, second-timer applicants with children aged 18 and below will get priority if they apply for a 2-room Flexi or 3-room BTO flat in Standard projects.

Seniors

2-Room Flexi Flats

Elderly citizens looking to right-size can apply for a 2-room Flexi flat, which allows them to enjoy the flexibility of choosing the length of lease of their flat based on their age, needs, and preferences, as long as the remaining lease can last them at least till they are 95 years old. The lease can range from 15 to 45 years, in 5-year increments.

At least 40% of 2-room Flexi flats are reserved for elderly applicants. Of this, half is set aside under the Senior Priority Scheme. This scheme gives elderly citizens who wish to age-in-place in a familiar environment or live near their parents or married children priority in buying a 2-room Flexi flat.

Find out more about 2-Room Flexi Flats here.

Enhancement for Active Seniors (EASE)

Launched in 2012, the EASE programme serves to make HDB homes safer and more comfortable for seniors through the installation of senior-friendly fittings such as foldable shower seats, rocker switches and handrails at flat entrances with steps.

Find out more about the EASE programme here.

Community Care Apartments (CCAs)

Launched in 2021, CCAs integrate senior-friendly housing with care services and social activities to support seniors to age independently in the community.

Eligibility

Applicant(s) and their spouse (if any) need to be 65 years old and above.

Flexible lease

From 15 to 35 years, covering applicant and spouse (if any) until at least age 95.

Cost of CCA

Prices of flats and details of Basic Service Package will be announced during sales launch.

Find out more about CCAs here.

Silver Housing Bonus (SHB)

Seniors who wish to sell their current flat and right-size to a 3-room or smaller flat may consider taking up the Silver Housing Bonus (SHB). Under the SHB, seniors will receive a cash bonus of up to $40,000 when they commit part of their housing proceeds to their CPF Retirement Account (RA) for their retirement payouts.

Find out more about SHB here.

Lease Buyback Scheme (LBS)

Seniors who wish to monetise their flats to enhance their retirement funds while continuing to live in their homes can also take up the Lease Buyback Scheme (LBS). Under the LBS, eligible flat owners have the flexibility to choose the length of lease to retain, as long as the remaining lease can cover them till at least age 95. They can then sell the remaining flat lease to HDB. Seniors will have to top up part of the proceeds from the lease sale into their CPF RA, and join CPF LIFE to receive a monthly income stream for life. This provides a steady stream of income in their retirement years, while allowing them to age-in-place.

Find out more about the various monetisation options here.

Singles

Singles can buy a flat on your own under the Single Singapore Citizen Scheme (SSC).

Eligibility conditions

- Singapore Citizen (SC), or include at least 1 other co-applicant who is an SC

- 35 years old or above

Housing options

Eligible singles may:

- Apply for new 2-room BTO Flexi flats in all locations, across Standard, Plus and Prime projects

- Subject to $7,000 income ceiling

- Buy an existing, Standard or Plus resale flat of any size, except for 3Gen flats

- No income ceiling for existing and Standard resale flats

- Subject to $14,000 income ceiling for Plus resale flats

- Buy a 2-room resale Prime flat

- Subject to $7,000 income ceiling

Housing grants

First-timer singles can enjoy an EHG (Singles) of up to $60,000 when you buy a new flat from HDB, and up to $115,000 in housing grants when you buy a resale flat.

- Enhanced CPF Housing Grant – up to $60,000 (for new and resale flat)

- CPF Housing Grant for Resale Flats – up to $40,000

- Proximity Housing Grant (Singles) - up to $15,000

Find out more about the SSC here.

Multi-generational Families

Family Care Scheme (FCS)

Under FCS, both married and single children will enjoy priority access when they apply for a new flat to live with or near their parents. The FCS comprises two components:

- FCS (Proximity): Parents and their child(ren), regardless of marital status, will have priority access if they are applying for a new flat to live with or near each other.

FCS (Joint Balloting)(From Oct 2025): Parents and their child(ren), regardless of marital status, will be able to jointly apply for two units in the same BTO project, where there are 2-room Flexi or 3-room flats offered in the BTO project.

Public Rental Schemes

The Public Rental Scheme helps low-income Singaporean households who may not be ready for home ownership as they are still building up their finances.Comlink+ Rental Scheme

We support public rental tenants holistically, by pairing shelter with strong social support and programming. For example, under the ComLink+ Rental Scheme, families with children living in public rental, will receive personalised support from a family coach in areas such as employment, health, homeownership, and education, upon their entry to public rental.

Fresh Start Housing Scheme

ComLink+ families living in public rental flats can apply for the Fresh Start Housing Scheme, to buy a Standard 2-room Flexi or 3-room flat on a shorter lease, ranging from 45 to 65 years. Second-timer families will receive the Fresh Start Housing Grant of $75,000, while first-timer families will receive the Enhanced CPF Housing Grant of up to $120,000.

Find out more about the Fresh Start Housing Scheme here.

Joint Singles Scheme (JSS)

Singles who are unable to form a family nucleus may apply to rent a 1-room public rental flat with another eligible single under the JSS. To enhance privacy, HDB offers flats with partitions to JSS households and where feasible, HDB will also install partitions in-situ upon request.

Single Room Shared Facilities (SRSF)

The SRSF model aims to give tenants greater privacy while providing shared facilities to facilitate social interaction. Each tenant will have their own bedroom that comes with basic furnishings, such as a bedframe, table and wardrobe, and have access to shared amenities like toilets, kitchens, dining areas and laundry rooms.

Home ownership Support Team (HST)

The HST was set up in 2019 to provide dedicated and more personalised support for rental tenants who are ready to purchase a flat. The team guides rental households through their home ownership journey – from planning their home purchase right through to the time they collect the keys to their home.

Rental households are also eligible for the Step Up CPF Housing Grant and Fresh Start Housing Scheme, which make home ownership more achievable.

Tenants’ Priority Scheme (TPS)

To help public rental families progress to home ownership, we set aside up to 10% of 2-room Flexi and 3-room BTO or SBF flats for families who have been living in public rental for at least two years.